Hi All,

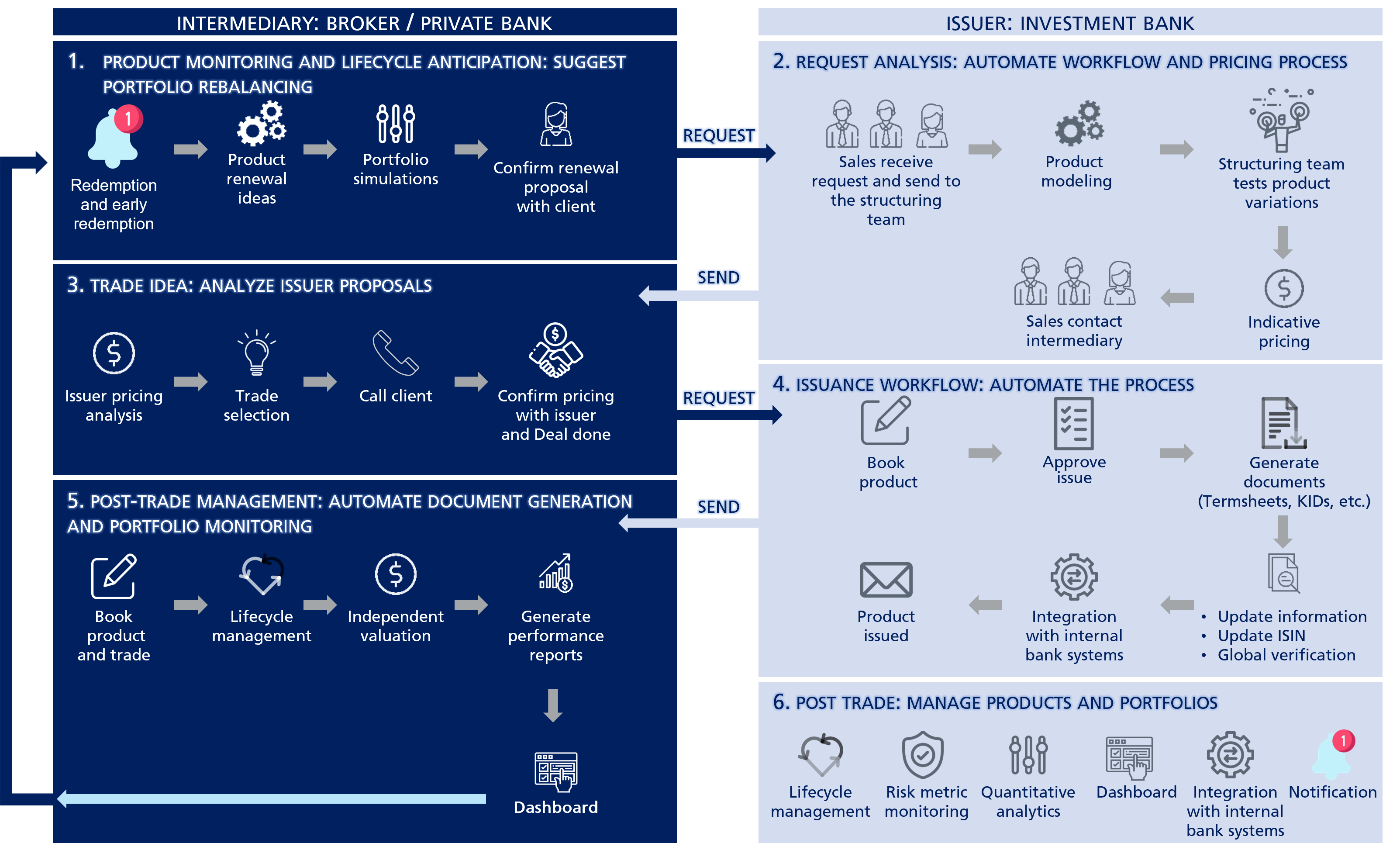

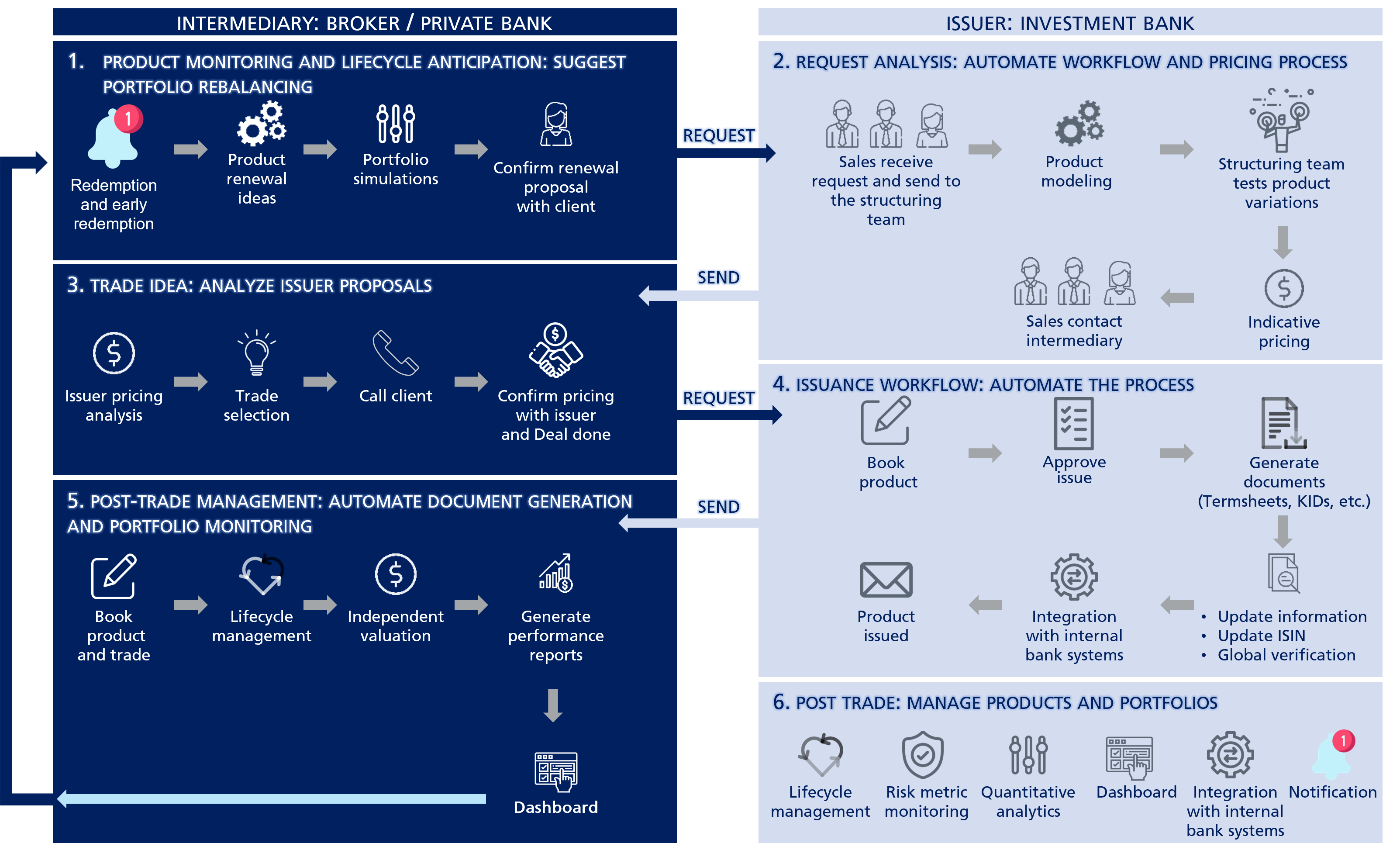

If you need to streamline your derivatives and structured products business processes, look no further LexiFi has the answer. LexiFi’s tools and functionalities allow automating all pre-trade and post-trade processes: from the idea generation to the issuance process and from the deal done to the lifecycle events and risk management; all this with the necessary documentation and reporting.

It has been over 20 years now that our technology is used by all types of actors in the structured investment market, winning industry awards both directly via LexiFi Apropos and indirectly via Instrument Box!

Figure: Issuer and intermediary workflow automation example.

Get in touch to know more about workflow automation in LexiFi Apropos!

The workflow Focus

Going forward, each Monthly Focus will illustrate workflows specific to an industry player!

Until then, find below some of our client success stories for each major actor in the derivatives and structured products industry.

1- Brokers: use case examples

|

"LexiFi Apropos is really the crossroad for all our teams: on one side the sales team for everything related to product monitoring but also marketing, the engineers for all lifecycle management matters but also repricing, and all our risk teams for which LexiFi allows monitoring risks and limits."

Clement Xuereb, Digital Transformation Manager at Kepler Cheuvreux Solutions

Read Client Story

|

|

|

LexiFi delivers tools and services that enable us to enhance the experience and the transparency of structured products. The software has increased both our productivity and the quality of our work."

Panagiotis Pavlidis, Structurer at Garantum

Read Client Story

|

|

2- Private banks: use case examples

|

"LexiFi allows us to automate important workflows such as customer confirmations, in-house term sheet generation, technical emails that are part of the operational process, and commission collection requests, to cite a few."

Frederic Lehner, Vice President – Structured Products Advisory at Lombard Odier

Read Client Story

|

|

|

"LexiFi Apropos answers our clients’ need to autonomously follow-up with their product evolution from their secured online banking account in a timely and transparent fashion. It’s a really beautiful tool for this purpose."

Pierre-Yves Druenne, Head of Product Management at Deutsche Bank Belgium

Read Client Story

|

|

|

"LexiFi more than delivered on its promise: LexiFi Apropos is a very well-designed system that continues to positively surprise us as we encounter new business challenges. LexiFi’s staff is competent and has a sincere desire to make the relationship succeed."

Pierre Stoll, Head of Fixed Income and Structured Products at Banque de Luxembourg

Read Client Story

|

|

3- Issuers: a use case example

|

"We have access to a large choice of pricing models in LexiFi Apropos for all asset classes. Plus, pricing and calibration are fast, well documented, and easily audited!"

Jordan CHU, Quantitative Analyst at CIC Market Solutions

Read Client Story

|

|

4- Asset managers: use case examples

|

"LexiFi's software allows us to prototype, define, value and manage tailored products through easy access to functions and data. The system makes communication more efficient both within NIM and with our clients. Also, LexiFi’s solution has been crucial for meeting both industry and regulatory requirements."

Abdoul Aziz Diallo, Head of Structuring at Solutions Natixis Investment Managers International

Read Client Story

|

|

|

"In 2020, despite the conditions under the COVID lockdown, LexiFi technical teams helped us -with a high level of proficiency and accuracy- to integrate the MMF reporting regulation."

Erwan Collec, Risk Specialist at Federal Finance Gestion

Read Client Story

|

|

5- Fintech companies: use case examples

|

"We are pleased to extend our integration with LexiFi based on the success of our earlier collaboration. We have been extremely satisfied with LexiFi’s technology, high-quality of service and support for our business. Their contribution has been valuable to the development of our new Bloomberg Derivatives Library, DLIB, and has enabled us to launch it significantly quicker."

Jose Ribas, Global Head of Derivatives and Structured Products at Bloomberg

Read Client Story

|

|

|

"The relationship with LexiFi demonstrates SimCorp Dimension’s aptitude for exploiting new technology, such as LexiFi’s ingenious system for describing and managing complex financial products, and the robustness of LexiFi’s novel approach. We look forward to furthering our partnership with LexiFi to address the delicate challenges posed by financial product innovation."

Jørgen Vuust Jensen, Former Domain Manager Financial Instruments at SimCorp

Read Client Story

|

|

|

"One of the biggest differentiators of LexiFi is their modeling of financial products through a clearly defined grammar with very good extensibility. The simplicity of the interface is also a notable competitive advantage. Besides, we were impressed by Instrument Box convincing computational speed."

Thomas Ulken, Lead Software Architect at Fact Informationssysteme & Consulting AG

Read Client Story

|

|

Client stories

Features

Many thanks!

LexiFi team