Hi All!

Imagine

A tool that helps you estimate and identify the exact sources of pricing uncertainty! Wouldn’t that be useful when structuring a product, querying prices from issuers or even managing expectations about prices?

You may say I'm a dreamer, but… ♫

This Monthly Focus covers our latest pricing innovation: a tool that allows LexiFi users to quantify and understand the sources of pricing uncertainty!

Imagine...

You are on the buy-side: what about a valuation interval for a given product that would give you an idea about what price distributions to expect from banks before making any query!

A structurer working with a new payoff or an exotic product: what about a tool that allows analyzing how sensitive the price is to uncertainty in the model choice, and imprecise factor observation? It could be a game-changer!

If you request prices from multiple banks and get unexpected price differences from each bank: wouldn’t be useful to understand if prices are inherently different, or if the price uncertainty is actually at the origin of these differences?

Pricing peace

-

What about a report to assess the fairness of counterparties’ prices in the secondary market?

-

What if you could compare a given price to that of counterparties with a criterion that is smarter than usual ad-hoc tricks and simple subtractions?

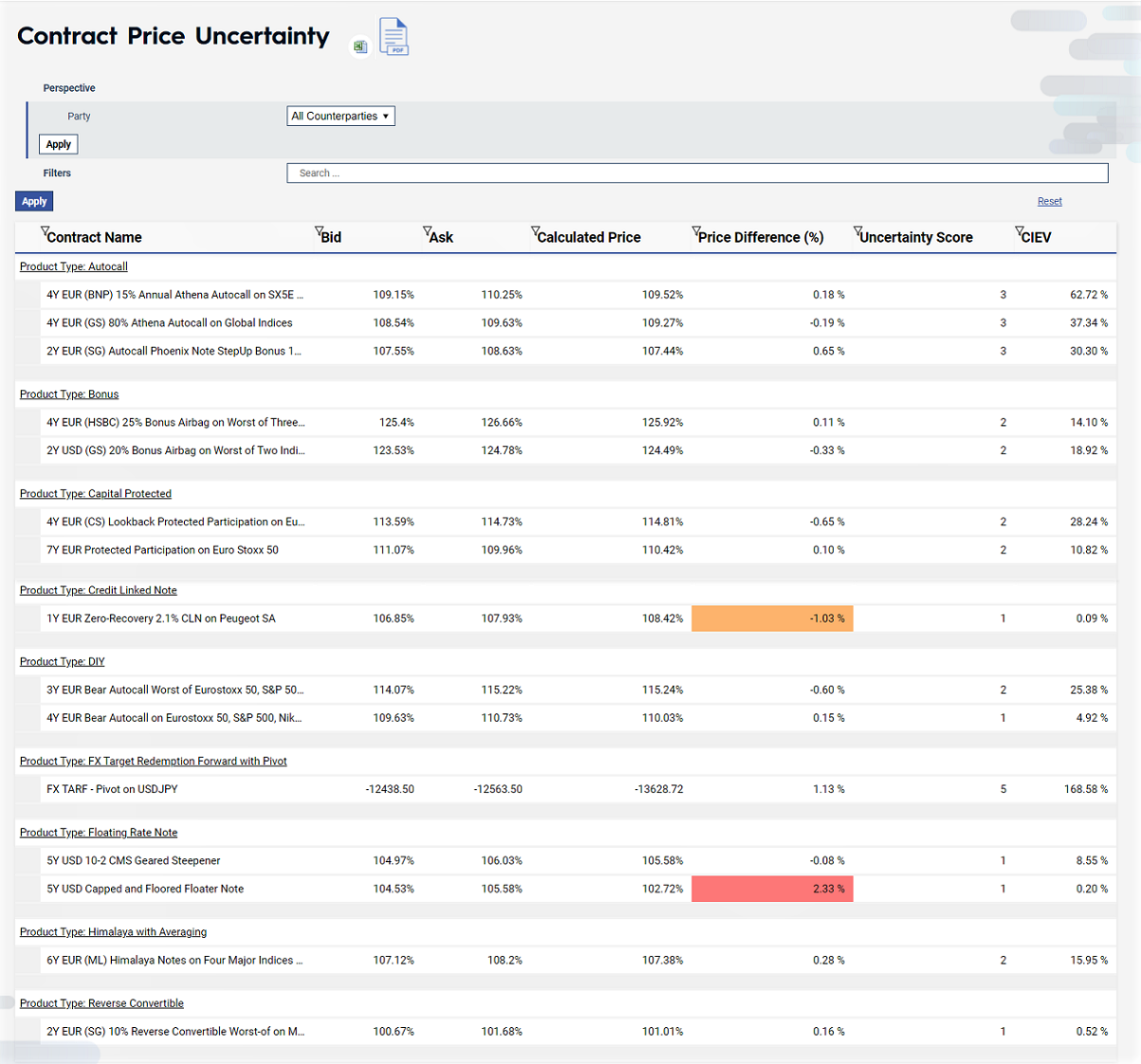

You may create custom reports that incorporate the Price Uncertainty analysis. You can define your own thresholds or check if the counterparty’s price is within the confidence interval defined in your analysis.

Below is an example of what such reporting view would look like:

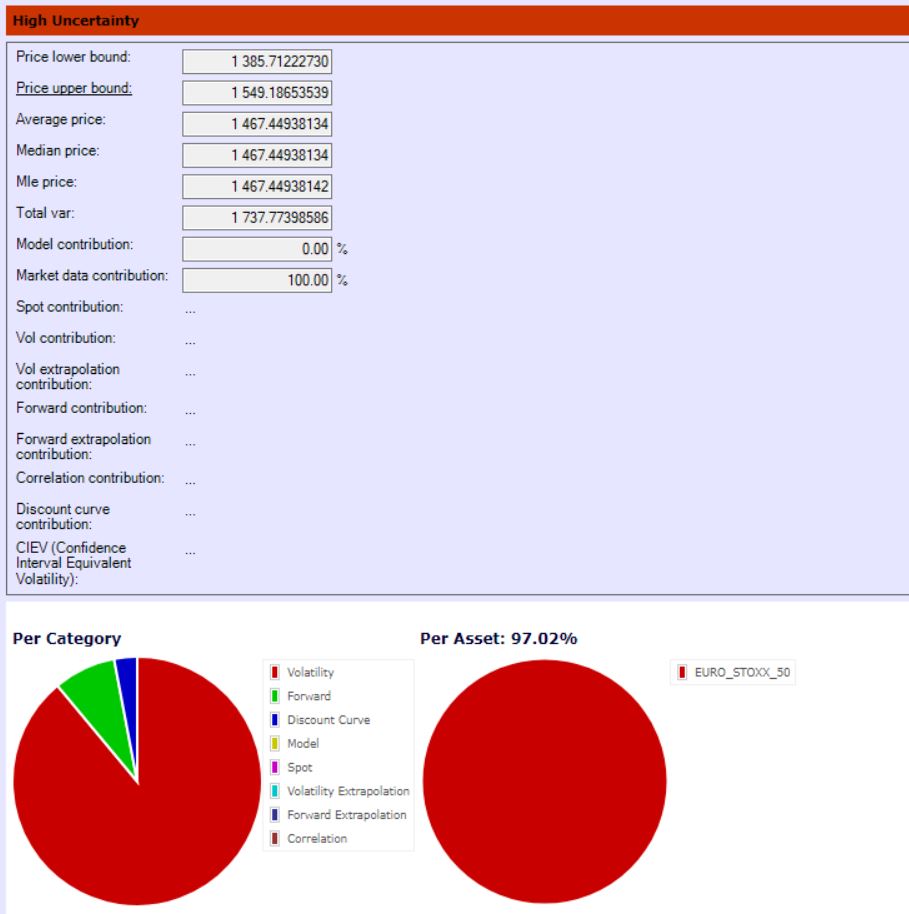

Computed prices for exotic derivatives often come with some degree of uncertainty. This is due to various factors including the difficulty to exactly observe market data or know the suitable pricing model.

In order to quantify price uncertainty, we have developed a tool that provides a confidence interval for a given price. The certainty level is measured by a volatility indicator that we define as the Confidence Interval Equivalent Volatility (CIEV).

Let us take the example above of a leveraged capital-protected product.

Looking at the contribution decomposition illustrated in the pie charts, we notice a large part of the uncertainty comes from the uncertainty on the EURO STOXX 50 volatility.

To improve the price accuracy, we suggest to take a closer look at the volatility data for this underlying:

- Use the Asset Volatility Inspector

- Check the volatility surface used by the counterparty

If it is not possible to improve the data or access the counterparty’s volatility data, we suggest two alternatives:

- Set up a proxy

- Apply an offset on the volatility that can be configured via the pricing adjustment parameter in the contract pricing profile on LexiFi Apropos