Hi All,

If you are in the structured products business, you should anticipate client needs and provide quality post-trade services around the clock. Luckily, technology gives you the opportunity to do so while controlling costs and operational risks associated with post-trade activities.

With LexiFi Apropos solution, you get a clear and timely view of lifecycle events affecting your clients’ portfolios.

But how can you share this information with clients in the most efficient and impactful way? This monthly focus outlines 4 ways to stand out to your investors through quality post-trade services!

1- Be a radar, not just an airbag

Keep clients posted with events on their portfolios in a timely manner! Assume you use the report below to monitor lifecycle events. You can alert clients about product events by clicking on the “send” button on your report. The click generates an email with attached relevant documents. You then cross-check it before sending it.

Some LexiFi Apropos users have fully automated emails that are sent directly to their clients.

2- Anticipate traffic and let them try out different waze

Anticipate product redemptions and portfolio rebalancing! One way to be proactive is to suggest suitable investment products to clients before product redemptions. It could be by changing product characteristics or trying different underlying.

What about a report listing all suitable investment product renewal alternatives? LexiFi Apropos allows to automatically generate such reports to match your exact needs. You may even go further and automate email suggestions to clients!

The Underlying Optimiser suggests the best underlying or underlyings’ combination. Combined with our Solver & Variations it becomes a very powerful tool to identify the magic formula! You can easily include these suggestions in a report thanks to the integrated nature of LexiFi Apropos solution.

Portfolio rebalancing and the Greeks

What about a report allowing to monitor the Greeks when suggesting portfolio rebalancing alternatives to clients. The report below allows adding/removing contracts while monitoring portfolio sensitivities.

Turn investors' market views into what-if analyses

If your clients have some market views that they want to explore within their investment portfolios, a common practice is to share with them a what-if analysis. LexiFi Apropos allows automating the generation of reports integrating clients' views on market evolution.

3- A look backward to safely move forward

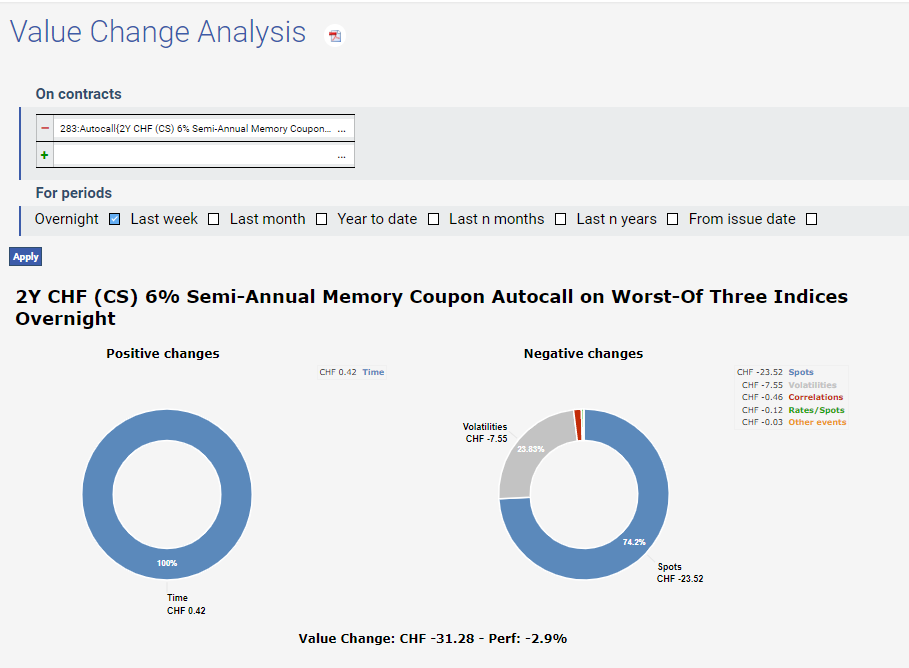

The Value Change Analysis report helps with PnL investigations and allows producing regular reports to send out to clients.

The screenshot above displays an interactive report embedding the value change analysis of an Autocall overnight. Reports can be downloaded as PDF documents.

4- A digital dashboard for greater clarity and easier reading!

Products and portfolio information should be easily accessible to clients.

LexiFi web is an application that has traditionally been used by our clients to provide access to their teams who do not need the full desktop application.

These last years, many have also launched client web platforms where investors can check their portfolio’s characteristics and P&Ls, monitor events such as the probability of barrier crossing, early redemptions, and download product documentation.

LexiFi offers the possibility to feed existing client web platforms with data and analytical results! The integration options have been carefully crafted for a seamless implementation.

We are pleased to share our recent interview with Kepler Cheuvreux Solutions demonstrating client services success with LexiFi tools!

Check out our recent client interview to learn about Kepler Cheuvreux Solutions' post-trade services success story!

Read Kepler Cheuvreux Client Story