Quantify and understand the exact sources of pricing uncertainty.

Computed prices for exotic derivatives often come with some degree of uncertainty.

In order to quantify price uncertainty, LexiFi Price Uncertainty tool provides a confidence interval for a given price. The certainty level is measured by a volatility indicator that we define as the Confidence Interval Equivalent Volatility (CIEV).

Example

Let us suppose you compute the price of an Autocall. Then, you calculate its uncertainty score with LexiFi Apropos methodology; here is a summary of the output result:

- The rating: in the example below the rating is “Moderate Uncertainty” provided by the CIEV close to 50%

- The price lower and upper bounds

- The sources of the uncertainty: percentage for the contribution of both the model and market data (for instance 70% for model, 30% for market data)

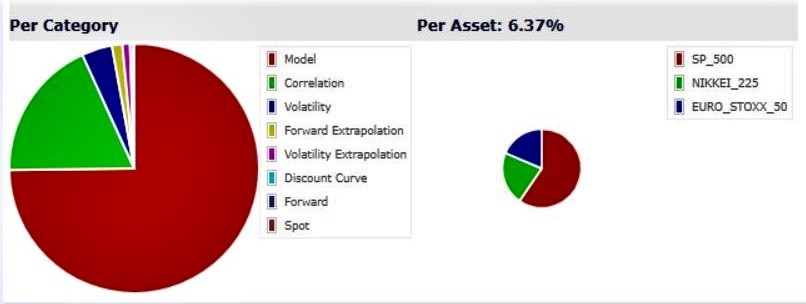

- A precise breakdown of the uncertainty contribution per underlying of the spot, volatility, volatility extrapolation, forward, forward extrapolation, correlation, and discount curve

- Visual breakdown of the different elements contributing to the price uncertainty per category (model, spot, volatility, etc.) and per underlying

Figure 1: Results of the price uncertainty estimation for an Autocall on NIKKEI 225, EURO STOXX 50 and S&P 500. The overall uncertainty is moderate.

The choice of the pricing model is a significant contributor (75%) to this price uncertainty as shown in the graph “Per Category.” Uncertainty related to the underlyings' market data represents 6.37%.

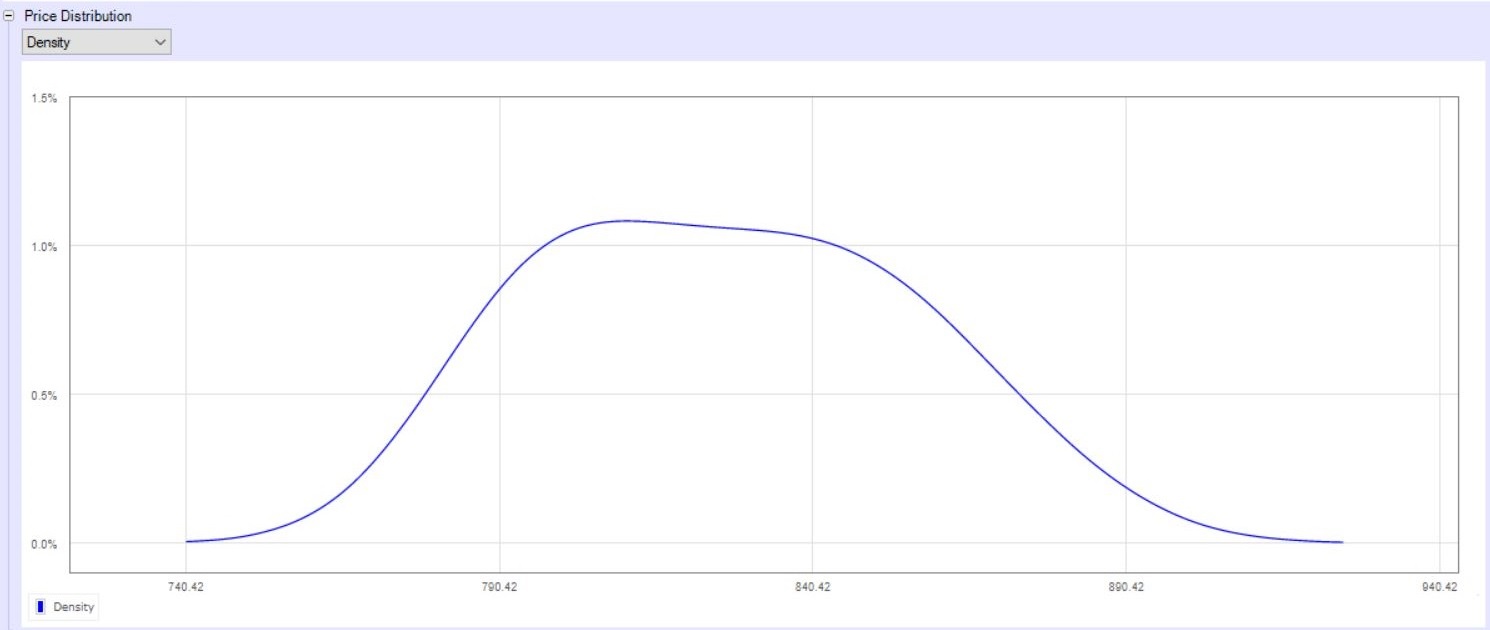

Figure 2: Price uncertainty: inspect its density derived from the factors' uncertainty.