Good Morning,

One of the biggest challenges facing the derivatives industry is investors’ perception of structured products’ risks! In an effort to educate investors about these risks, regulators require frequent reporting, and granular calculations. Meanwhile, banks’ compliance and risk departments are challenged by the lack of a consistent and efficient methodology to produce scenarios for bespoke structured products and portfolios.

LexiFi’s objective is to provide tools that help financial institutions overcome such challenges quickly and thoroughly! This Monthly Focus edition is about LexiFi’s Risk Scenario functionality.

Know the impact of any shock!

How would your portfolio have reacted in 2008 ? What would be the impact of a Pan-European equities crash? Or a shift in the price of an individual stock? How do you ensure a consistent methodology for computing risk indicators?

The scenario analysis approach is an effective way to estimate the potential impact of hypothetical events, manage expectations and mitigate risks.

With LexiFi’s Risk Scenario tool users can define, store, combine and reuse fully customizable scenarios tailored to their needs or regulatory requirements, and mitigate risks.

How are clients using the Risk Scenario tool?

Our clients have been using the tool to respond to both regulatory and internal requirements; these include:

-The production of sensitivity analyses as inputs for the SCR, SIMM and FRTB computations

-The generation of what-if analyses and custom risk metrics based on market views as well as key risk indicators requested by the internal Risk Management department

How does it work?

1- Define scenarios by browsing the drop-down menu of “Scenario parameters”

2- Click on the “Calculate” button: LexiFi Apropos executes the defined scenarios as if they all occurred instantaneously

For each scenario the software returns:

- the price of the product or of a portfolio of products

- a price difference with the baseline price of the product or portfolio

The intuitiveness and the power of this feature originate in the combination of LexiFi’s pricing models for each simulation and basic operators to aggregate or sequence scenario events!

Compose, combine and transform

The Risk Scenario tool offers full flexibility for the creation of scenarios. This means that users may create and regroup different shocks within one scenario. The list below is a summary of the tools to do so. You may refer to the Risk Scenario page on our website to learn more:

- “Explicit” applies a shock to explicitly specified market data items, usually from the spot (“initial”) market data environment

- “Transformation” specifies a shock to perform on all market data items of a given subset

- “For all” to apply a scenario to all the items of a specific kind simultaneously

- “For each” to apply a scenario simultaneously to all market data items of a specified category

- “From…to…in…steps transformations” defines a list of shocks to apply successively to a given subset of market data items

Scenarios can then be combined in different ways. The user is free to choose the scale of the approach, from a micro focus, based on a small number of precise situations to a very broad macro view, characterized by a large number of shocks.

- “Union” to execute each scenario from the spot following the order of the list of defined scenarios

- “Compose” technically, produces the “Cartesian product” of the listed scenarios

- “Sequence”, can be seen as a mix of “Union” and “Compose”

Short of inspiration?

The tool presents pre-defined unitary scenarios to allow you to produce a variety of risk scenarios. LexiFi users usually combine elements from the list below to build specific scenarios:

- Non-parallel yield curve shift

- Rate buckets

- Credit spread shifts

- Asset dividend shifts

- FX spot shifts

- Spot and volatility surface shifts

- etc.

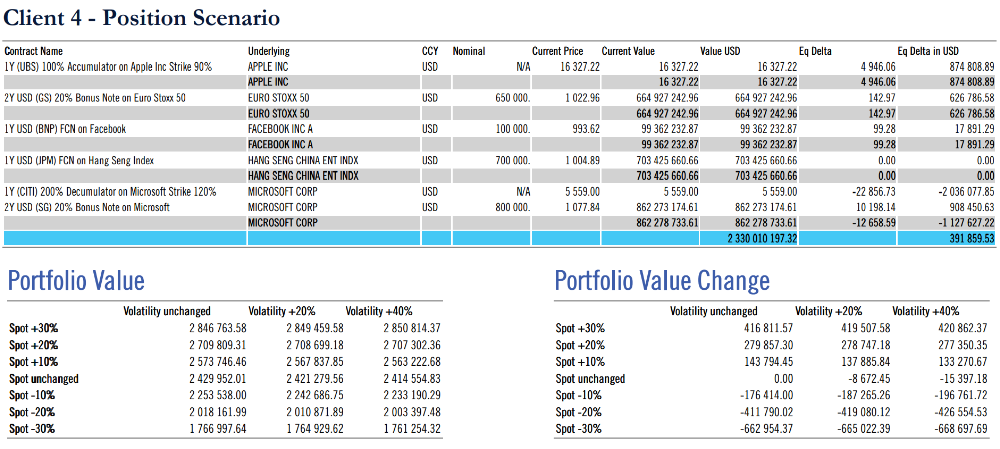

Risk report example click to zoom in

Reporting

All pricing results obtained with Risk Scenario, from price changes to individual market data items shocked in each scenario, are accessible from LexiFi Apropos’ document generator allowing you to create custom risk reports.

Users often incorporate Greeks’ analyses and VaR results as part of their risk scenario reporting.

LexiFi Apropos allows complete customization of specific documents, exportable in HTML or PDF formats and readily exploitable by our users.