When a client is ready to place a trade, financial institutions are required to ensure the trade is suitable and executed according to best execution practices.

But getting clients to the point of placing a trade requires quite a bit of work. Much of this work pertains to what is done after trade execution.

This might sound a bit confusing, but the point is: the way financial institutions carry out post-trade activities has a great influence on future trades clients might place.

In 2020, the Bank of England issued a report: The Future of Post Trade, Findings from the Post-Trade Technology Market Practitioner Panel [1]. This report emphasizes the problems found in post-trade processes and their impact on future trade decisions. The different approaches to processes across firms and outdated legacy systems were listed as the main causes of operational errors, rising costs, and inefficiencies, which deter investors from their trade decision-making.

Being Proactive

Activities such as market research and product marketing are important to garner clients’ attention and present new trade ideas to them. As with any sales process, timing is important. Having a proactive approach to trade management helps provide the appropriate opportunity to present actionable trade ideas to investors.

Clients with diversified portfolios can find it challenging to keep track of their different investment products as markets move. By proactively managing these products, financial institutions can help clients focus on events that might materially impact their portfolios. This means providing investors with relevant information in a timely manner helps them make intelligent decisions with regards to their portfolios.

For example, events such as upcoming expiries, asset deliveries, corporate actions, or likely barrier events, when reported to clients in a timely and proactive manner ultimately give them momentum to consider their next course of action. Thanks to such interactions, investment product ideas can be presented to clients in tandem with the happenings in their portfolios.

In 2016, ISDA published a whitepaper The Future of Derivatives Processing and Market Infrastructure [2] where it underlines the need for trade reporting and monitoring in the post-trade process to serve two purposes: reduce the systemic risk and provide investors with more transparency regarding their portfolios’ positions. Despite reporting and monitoring regulatory pressures, ISDA shows that these requirements should be a point of focus.

Providing better client services

Ultimately the goal of financial institutions such as Private Banks, Wealth Managers, and Family Offices is to help clients make the right decisions so that they can reach their financial goals. Providing clients with a clear view and timely information regarding their portfolios, naturally puts them in a better position to make the right decisions.

While there is a strong focus on best execution and suitability, it is also important to provide a holistic service to clients and go beyond the trade.

To provide the relevant information to clients, it is essential that financial institutions carry out post-trade or lifecycle management activities on products and trades within client portfolios.

Recognizing the challenges of going beyond the trade

The benefits of going beyond the trade are clear, but there are complexities in achieving this. The diverse nature of investment products within client portfolios can pose a challenge to carry out post-trade and lifecycle management.

In 2019, Deloitte published a report Future of Post-Trade, Shifting the Cost Curve [3] where it highlighted challenges for the industry. This report underlines the difficulty to transition and exit from heavy existing infrastructures and legacy systems. New regulatory requirements put more pressure on financial institutions and according to Deloitte, possible solutions include establishing industry standards and adopting the right technology.

While the adoption of post-trade industry standards is a long-term complex objective for which financial institutions lack control, using the right technologies could be the first step.

Adopting the right technology

It is therefore important that financial institutions have the right platforms in place to manage post-trade processes. A cost-effective infrastructure that can help to ensure a high level of automation and the ability to handle the diversity of products is crucial to be able to manage post-trade activities efficiently.

Efficiency is key here because the capacity to seamlessly manage product portfolios drives the ability to provide clients with the timely information required to make sound investment decisions.

This is further highlighted in an article Poised for Digital Transformation: Derivatives Post-Trade Processing by Angie Walker in 2021 [4]. The lack of up-to-date systems and the multitude of workflow processes hinder banks’ efficiency resulting in greater costs and operational errors. The use of new technologies through innovative FinTech and platforms is the best answer for financial institutions to navigate the derivatives industry challenges.

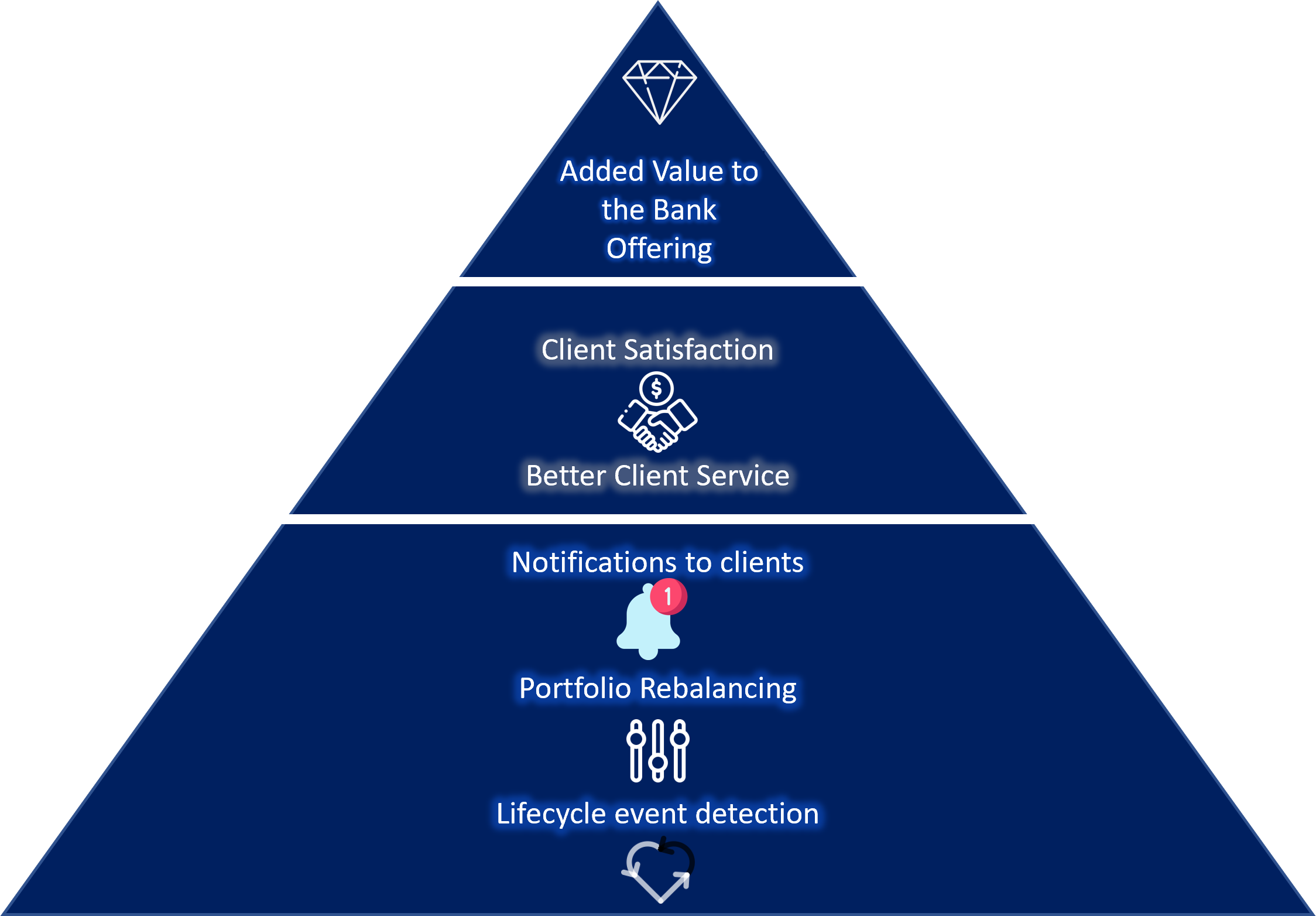

Figure: The post-trade pyramid. Source: LexiFi 2022.

Figure: The post-trade pyramid. Source: LexiFi 2022.

Worthwhile going beyond the trade

Post-trade management plays a critical role in providing clients with value-added services. But the benefits go beyond that. From managing risks to enhancing compliance processes, post-trade management enables many other processes within institutions by providing data and insights.

These numerous benefits make a strong case for financial institutions to consider going beyond the trade.

Resources

[2] The Future of Derivatives Processing and Market Infrastructure, ISDA 2016

[3] Future of Post-Trade, Shifting the Cost Curve, Deloitte 2019